2021 Annual Letter

To My Investors,

The stock market had another strong year in 2021, gaining 30%. Our stock returns were around 23%, with most of your portfolios up about 18% after taking cash balances into account.

This is the second straight year of underperformance, bringing the total two-year returns on our equity portfolios to +41% compared to +51% for the stock market. I’m going to examine that underperformance in this letter in the context of our strategy and long-term goals of earning strong after-tax returns without taking undue risk.

As always, we’ll look in more detail at our trading activity for the year and the performances of the businesses that we currently own. Last, we’ll examine the current market environment and how I’m attempting to position us to achieve our long-term goals.

What are we trying to achieve?

In general, as I’ve spoken with you all about your goals, a consistent pattern emerges – I hear that you would like to make a good return over time on your money without taking significant risk.

That sounds like a boilerplate answer, but there are hidden complexities in it. Much of what is important to you all lies in what is not said. There is no mention of sharpe ratios, outperforming the S&P 500 every year (or quarter), aiming for consistent top decile performance, or keeping up with the market in times of excess. Most money managers are shackled to these sorts of constraints by their clients, which forces short-term thinking. I have the luxury to think long-term because you all think long-term. It is our greatest advantage.

The implications of “without taking significant risk” are equally important. Risk is a difficult concept to define, but in our case, avoiding risk would be, at the minimum, avoiding situations where we would experience a permanent loss of capital. There haven’t been too many US based investors that have experienced permanent losses of capital during the time that we have been investing together (since 2013), but our time horizon is long, and a long time horizon will expose overly risky behavior. In a lifetime of investing, we are almost certain to face difficult investing environments, and those who have been taking too much risk over time will be wiped out.

How have I designed your portfolios to generate good long-term returns without taking undue risk? The two main ways have been to increase both the quality of the companies that we invest in and our diversification.

Last year I wrote extensively about quality and leverage - even in the depths of the COVID recession when the world was shut down, every company we owned was generating positive earnings and free cash flow and was financed in such a way that they could endure those depressed conditions if they lasted for an extended period. After portfolio moves in 2021, I would argue that our portfolio is even higher quality than it was in 2020.

I have also moved towards more diversification, with our top positions being around 10% of assets, down from 15-20% as they were a few years ago. Instead of owning 6-7 businesses, we now own about 15. Any mistakes that I make (and I made one this year on Altice, more on that later) will have less of an impact on our total portfolios given smaller position sizing.

Calling back towards the top of this section, our goals are to make a good return over time without significant risk. Owning higher quality companies and using more diversification might lead to lower returns, but it unquestionably reduces the risk of losing our principle over time.

We are not trying to maximize returns. We are trying to invest our money in such a way that we survive and thrive over time. The future is unknowable. We are likely to have terrible investing environments due to unforeseen risks over our investing lifetimes. By owning a more diversified group of higher quality businesses, we increase our chances of achieving those goals.

Holding… and holding… and holding

I spend most of my time in these letters writing about the kinds of companies that I like to buy - high quality, growing businesses with excellent management teams. I haven’t spent a lot of time talking about what happens after we buy these businesses. When do we hold? When do we sell?

These are especially relevant questions when you consider our underperformance over 2020 and 2021 along with this quote from the 2019 letter:

Even so, as I look at the rest of our portfolio, I see significant overvaluation. I expect our returns to trail business results at Transdigm, Constellation Software, and Charter due to high valuations. I still expect longer term returns of at least 12% for each stock, but when you are at a point of initial overvaluation, returns can be somewhat lumpy. The stocks might gradually underperform the businesses over time or there could be a more severe valuation correction. I expect more volatility over the next five years than we have generally seen over the past 5 years, but if our businesses perform we should still make good long-term returns.

Looking back on it, I might change a few words of that paragraph, but that prediction has largely come to pass. That group of companies, by itself, has led to almost 6% of underperformance relative to the stock market, which is over half of our ~10% total underperformance over the past two years.

This begs the question – if I thought that there was a good chance at underperformance with these companies, then why didn’t I sell the stocks?

Taxes. Most of you invest with me through taxable accounts, and when you say you would like to make a good return over time without taking significant risk, it is important to clarify that we are trying to generate strong returns after tax. Given high marginal tax rates for many of you, frequent buying and selling would eat away at your returns – in order to earn a hypothetical 12% after-tax return over a long time frame, an investment manager who buys and sells frequently would need to earn 20%+ pre-tax returns, a feat which only perhaps 2-3 investors have ever achieved.

Given the near impossibility of driving strong after-tax returns via frequent trading, the best way that I can see to generate those returns is to be a long-term owner of high quality businesses. If you can find a business that will increase in value over time, and you hold your shares, then you defer the need to pay taxes on those gains, perhaps indefinitely.

When I initially buy an investment, my goal is to find something with such high quality and durability that we can hold the stock for decades and earn strong returns without selling and paying taxes. This requires a lot of effort and, admittedly, some luck. Even if I’m not always successful, consciously striving towards this goal will get us closer to the types of investments that will be best for us on an after-tax basis.

Now, revisiting the paragraph from the 2019 letter, why continue to own those stocks that I thought were overvalued? These are all companies that I think we can own for a long time, perhaps indefinitely. When I think about selling them, I don’t think about the current trading price of the stock; instead, I’m interested in the price that we will receive on an after-tax basis.

We had large embedded gains in all of these investments, so the tax bill on a hypothetical sale would have been large - if I sold all of those investments at the end of 2019, many of you would have paid around 18% of the total proceeds in tax.

While that group of stocks underperformed the stock market by about 10% between 2020-2021, if we would have sold them, paid taxes on the proceeds, and invested the remaining funds into the market, we would have ended up with even less money. In this hypothetical scenario, $1 in value at the end of 2019 would have turned into $1.24 instead of the $1.41 in value that we currently own.

Given these dynamics, oftentimes it makes sense to just hold on to good companies even if they seem somewhat overvalued. I remember mentioning to many of you in 2019 that after our big run that year, when our equity portfolios were up ~50%, that it was pretty likely that we’d underperform over the next couple of years. That’s exactly what happened.

Holding things that look overvalued, bluntly, can look sort of dumb. Underperforming over two years isn’t particularly fun, but it is a natural byproduct of what appears to me to be the best strategy to outperform after tax over time. It has worked pretty well for us - in the 9 years we’ve been investing together, our equity portfolios have outperformed the stock market by roughly 2% per year after fees and tax.

Trading Activity

This was a relatively busy year as I started to diversify our portfolios a little more than normal. I bought positions in Amazon, Visa, Mastercard, Facebook, IHS Markit (now part of S&P Global), Radius Global Infrastructure, and Altice. Altice was a mistake, and I’ll discuss it in more detail in a later section. The others tend to be dominant growth businesses that for one reason or another underperformed this year and looked to offer attractive returns going forward. Most of these positions are fairly small, and we’ll look to increase our positions in the future if the opportunity presents itself.

My biggest move this year was to sell all of our position in Magellan Midstream Partners and about half of our position in Enterprise Products Partners. I wrote last year that I misestimated these businesses when I bought them and would look to sell these stocks if I could get a reasonable price for them. Both were up strongly at one point in the year and I did sell. This brings a long, painful few years of owning a large position in energy investments to a close. We do still have a 3-4% position in Enterprise, but the days of having 15%+ of your money in energy are over, likely for good.

Business Performance

I’m going to shorten this section this year in the main letter and put a little more detail in a technical appendix at the end of the letter. This section will provide a good summary for how our businesses performed in 2021. If you know what EV / EBITDA, tangible book value, or discounted cash flow mean, then that section will provide you a little more insight.

Constellation Software continues to consistently execute its playbook of running its large stable of software companies well, generating lots of cash, and using that cash to acquire more software companies and drive free cash flow growth. Over the 5 years we’ve owned the company, our share of earnings has increased by ~156%, which is a 21.8% annualized gain. Our return is somewhat higher given an increase in the valuation.

Transdigm had a fairly uneventful year in 2021. Air travel continues to stay well below its pre-pandemic peak, which has reduced demand for the aerospace parts that Transdigm sells. Even with weak end markets, the company is still solidly profitable and generates good cash flow. I would expect today’s price to look quite attractive if air travel recovers to somewhere near pre-pandemic levels in the future. Obviously the pace of a recovery is unknowable, but we can afford to be patient, and once the worst burdens of the pandemic have passed, it is almost certain that people will continue to travel at historical rates.

Charter had a good year in 2021, although a combination of a high valuation coming into the year, increased competitive threats, and slightly lower expectations for future growth led to marked underperformance for the stock. The risk of more competition, mostly in the form of telecom companies building fiber over Charter’s network, has always been present and is something that I’ve monitored closely.

It’s always important to quantify risks like this, and even if I assume much more competition than expected, returns from these prices still look very strong. If the stock price continues to stay relatively low and the business does continue to grow, the company’s substantial share repurchase program will increase our long-term returns.

Google has had two remarkable years since we bought it, as the value of the company has roughly doubled in that time period. Google’s core business has continued to grow at a rapid pace, its margins have increased, it has significantly grown its cloud infrastructure business, and it has started to return excess capital to shareholders via share repurchases.

Berkshire Hathaway continues to consistently and conservatively create value. We have owned it for 8 years, and in that time it has increased its value by about 12% / year while Buffett has run the company with an excess of financial conservatism. Our investment has trailed a very strong stock market over that time frame, but we don’t own Berkshire to crush the market, we own it because it’s a relatively safe way to make a satisfactory return.

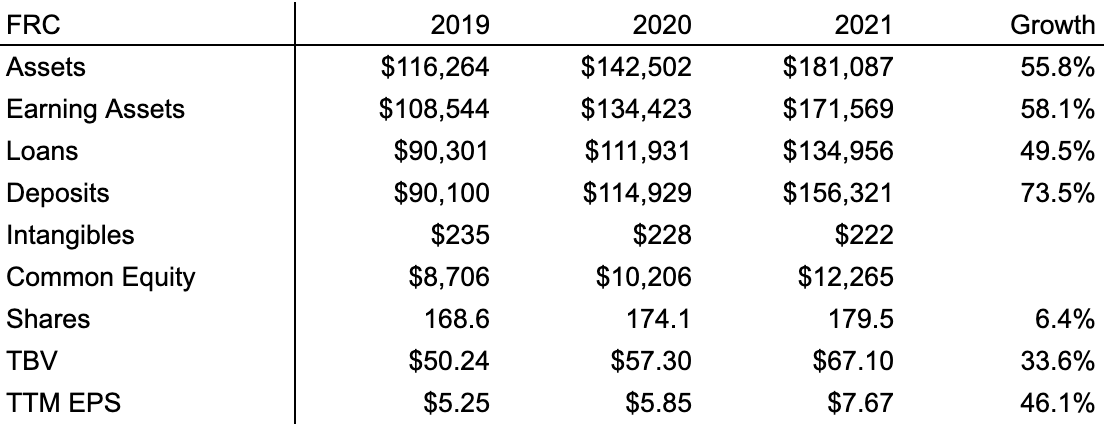

First Republic Bank continues to serve its clients well and use positive word of mouth to drive growth. Over the last two years, the bank has grown its loans and deposits by over 50%, mostly from increased business from current customers along with direct referrals. More importantly, it has kept its credit standards high and has suffered minimal levels of loan write-offs. Our share of earnings has grown by 37% over that time, and First Republic’s focused customer service model should lead to consistent growth over time.

We have owned those businesses for at least two years and they also make up the bulk of our invested capital. Our remaining investments are both smaller and newer so there isn’t anything material to report on their performance while we’ve owned them. There will be more to say on these businesses in the future.

Altice

Altice has been, by far, our worst performer. I would normally put it in the “Business Results” section but I think it deserves its own. Since I bought our shares, the business has performed worse than expected, and due to a large amount of debt, the stock has dropped a significant amount. Our average cost is in the mid to high $20’s and the stock currently trades around $12.

Buying Altice went against all of the principles that I laid out in the beginning of this letter - I want to buy and hold a group of durable, high quality companies. You can see my initial reasoning for the purchase here. I knew upfront that this business isn’t nearly as good as the other companies in the space, management is equally weak, and there’s a lot of debt. And yet, I was seduced by a price that looked low.

I thought that even though there was more risk here than we’d normally take, the odds of success were quite good and the payoff would be high. Sometimes you are paid enough of a price to take on high uncertainty – you might not be willing to bet any money on a fair coin flip, but if the odds that heads came up was 75% and if you made $10 on heads and lost $1 on tails, then it would be a worthwhile bet, at some size.

Some investors are good at this kind of investing where you buy stocks in higher risk companies with a wide dispersion of outcomes. It makes sense for them to play this game. I am not good at this kind of investing, and I should not do it.

Ignoring quality and focusing on a low price that I think is an attractive bet is a frustrating mistake to make, because it’s the most common mistake that I’ve made over my career. It happened when I invested too much money in energy, it happened when I bought Wells Fargo, and it happened here. I am especially prone to making it when stock prices look relatively high and I get impatient to just do something, anything.

The only thing that has lessened the consequences of the mistake is that I bought gradually and did not make it a huge position, so the losses have been manageable at roughly 3-3.5% of total assets. With my previous, more concentrated strategy, the results would have likely been worse.

I have not sold our shares yet. The range of future outcomes is admittedly wide, but under most circumstances, I believe that the company is worth far more than $12. Importantly, even if that ends up being correct, the whole ordeal will have still been a mistake. I shouldn’t have put any of your hard earned money into this idea in the first place since it doesn’t fit into our larger strategy.

Future Outlook / Q1 2022 Trading

I have delayed the final release of this letter, and I’m finally publishing it at the end of March 2022. I wanted to use the weak markets of Q1 2022 (although as of this writing they’ve largely rebounded) as a practical guide to how I usually invest during down markets.

For most of you, I manage your entire net worths. I usually keep roughly 20% of your accounts’ combined value in cash or short-term government bonds. I generally view it as prudent for almost every individual investor to have some safe assets in their portfolios to provide flexibility during difficult markets - safe assets can provide some ballast in a portfolio but can also be a personal safety net in the case of unforeseen personal expenses, job loss, or any other life surprises.

Along with those benefits, holding cash also gives us money to buy stocks if they’re selling off. In the first quarter, as stocks started heading down, we were steady buyers. Consistent with how I’ve operated in past down markets, I was frequently buying in relatively small amounts. In some cases, I also trimmed or sold some of our better performing stocks to buy others that were more beaten down.

When we do get a weak market, my goal isn’t to find a risky idea that will make a huge return if everything goes right but lose us money if it doesn’t. Instead, the goal is to gradually add investment dollars to very high quality stocks that will, unquestionably, be able to withstand the difficult environment.

Over time we tend to make most of our money during these difficult periods. As I mentioned in last year’s letter, consistently buying stocks during the market meltdown around COVID added roughly 10% to our returns in 2020. I expect that our purchases in early 2021 will similarly work out well for us over time.

I have stopped providing “outlooks” for the future where I make any types of predictions on what the economy looks like or how expensive stocks are. The stock market might be trading at relatively expensive levels, especially if we get more persistent inflation. It also might generate strong returns. The future is uncertain, as it always is.

I always keep your goals front of mind - make a good return over time on your money without taking significant risk. We are more diversified than we have ever been. We own higher quality companies than we ever have. We have plenty of liquidity. If stock markets continue to generate strong returns in the future, we should make satisfactory returns as the majority of your money is invested in stocks. If stock markets have a weak stretch, then we’re in a good position to use more of our available cash to buy high quality businesses that should generate us good long-term returns.

This strategy almost guarantees that we will not be the best performers in any one environment, but we should have good performance across most environments.

Conclusion

We had a decent year in 2021. We are more diversified than when the year started, we own high quality companies, and we made a decent return on our investments, although we underperformed the stock market as a whole.

My mistake with Altice cost us some performance. On top of that, some of the businesses that we’ve owned for many years looked expensive coming into the year, and those stocks lagged a bit as well. But owning quality businesses for the long-term is the best way to generate the strong after-tax returns that we’re looking for, without taking undue risk. Some years, like this one, this strategy is likely to lead to some underperformance, but it has worked well for us over time.

My goal is to protect and grow your capital over the long-term. I won’t chase hot stocks or unprofitable companies. I’ll continue to invest in good companies at reasonable prices. If I can’t find these opportunities, then I’ll be patient until I see the next opportunity. No matter what the future holds, I believe we’re well positioned to make strong returns over the long-term.

Technical Appendix

In this section I’ll go over the business results at our larger investments. I’ll share some thoughts on past performance of these businesses, valuations, and future expectations.

Constellation Software

We have owned Constellation for 5 years. In that time, adjusted EBITA per share has increased from $25 to $66, which translates to 21.8% annualized growth when you include some modest dividends.

The performance has clearly been excellent, although I think it’s unlikely that Constellation will grow > 20% for too long in the future. They’ve done a terrific job since early 2021 in closing some larger deals that are using up more of their free cash flow, but returns are likely to be somewhat lower than their bread and butter small deals.

The stock is trading at roughly 34x my estimate of run-rate FCF, which is on the high end of its historical range. The market is clearly excited about these bigger deals and the possibility that the company can put all of its FCF to work in M&A. But it’s a rich multiple especially considering that the base businesses are only worth perhaps 13-15x FCF. The M&A engine will need to continue creating large amounts of value each year to get a great result in the stock.

If they deploy the majority of their FCF into deals at 25% IRRs (slightly lower than historical returns to adjust for larger deal sizes) then the returns from here can still be quite good, probably >12%. In most reasonable cases, returns should come in >8%, which I find acceptable given Constellation’s diversification, nonexistent leverage, rational management, and likely antifragility if we ever get a real software bear market.

Transdigm

Transdigm’s equity has fully recovered from COVID, although the end markets continue to be depressed.

I look at valuation based on my estimate of their 2019 profitability, then I try to think about normalized growth off of that base assuming an aerospace recovery. Pro-forma revenue from Transdigm’s base business in 2019 was $4.65B and revenue from Esterline was $1.37B. If we ultimately recover to a normal trend off of 2019 numbers, I would expect something like 5% organic revenue growth per year, so a normalized revenue number for 2022 would be ~15% higher than 2019. I figure we might only ultimately recover to 90% of the trend level so use those two numbers as an estimated range for normalized revenue.

Looking at margins, Esterline margins were still on their way up after the acquisition by the time COVID arrived, and I estimate that margins will be much higher once aerospace markets recover. My first guess is that on recovery we’ll see ~50% EBITDA margins at Esterline businesses and 53% margins at legacy TDG businesses. There could be puts and takes but I think that’s a decent ballpark estimate.

Putting it all together, assuming a range of 90-100% of an aerospace recovery back to the 2019 trend, we get normalized 2022 EBITDA estimates of $3.3-3.7B. Applying a 16x EBITDA multiple, consistent with its historical range, would give us an equity value of $635 - 733.

The stock looks like it’s more or less to its normal trading range, assuming a strong recovery. But at that multiple, it can generate mid-teens IRRs without M&A if it can achieve 6% organic growth over time and if it runs at 6x leverage. We also got a small deal in Q1 2022 that should generate ~$10 / share in accretion and my hope is that they have some more M&A in the future which would add to the return.

Berkshire Hathaway

We have owned Berkshire for 8 years, and the company has compounded book value per share at just over 12% over that time. The gain in intrinsic value, according to my estimate, is a bit higher than that 12%.

Buffett has been using roughly all of the FCF at Berkshire to buy back stock over the past couple of years, which I wholeheartedly support. Given their size and apprehensiveness about using too much leverage, I think they’re at a disadvantage in large buyouts, an argument supported by the fact that their last two large deals have worked out poorly. Their opportunity set on the public equity side is also fairly small, given their size, although Buffett’s Apple investment has been a home run.

Large buyouts or purchases of equity investments during non-distressed periods necessarily carry some business specific risk. With Berkshire’s stock reliably trading at a demonstrable discount to intrinsic value, I view consistent repurchases as a great way to increase per-share value, especially on a risk-adjusted basis.

The stock looked reasonably valued at the end of 2021 and has had a strong start to 2022. As of March, it’s trading above its historical trading range over the past 10 years but doesn’t necessarily look expensive. It should continue to provide us solid returns and should do well in an environment with higher real rates if we get it.

Charter

As mentioned above, Charter had a great year in 2021. We have owned it since spring 2018, and over that time, operating free cash flow (defined as EBITDA - capex) per share has grown from $25 to $67, which is 30% annualized growth. In 2022, we should have somewhere around a 16-17% FCF yield-on-cost from our initial investment.

Last year, every variable continued to move in the right direction - increased broadband subs, higher pricing, lower cost to serve, higher margins, lower capital intensity, and a lower share count.

All that said, the outlook for future broadband sub growth has weakened, sending the stock from ~$810 to $550 in a few months. There are less DSL subscribers to take as cable companies have converted many of them already, we’re seeing increased fiber builds from telcos, and 5g fixed wireless is proving to be a threat. All of these factors together should translate to slower subscriber growth than expected along with less of an ability to take price.

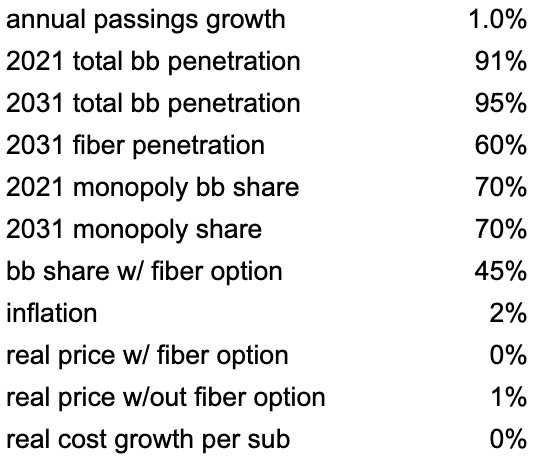

I made some estimates that I believe should be conservative about the evolution of the broadband market over the next 10 years:

These assumptions give total net broadband adds of roughly 1mm over the 10 years, broadband penetration dropping > 300bps, almost no real price increases, and stops the trend of cost to serve dropping consistently.

Even in this scenario, we should see perhaps 2-3% EBITDA growth per year, and we’d get low-teens IRRs with a terminal multiple of 10x TTM FCF.

I would expect most of those assumptions to be conservative, especially with an aggressive mobile strategy and relatively low pricing. But the environment is more uncertain than it was a year ago and given leverage in the capital structure, any surprises will be pronounced in the equity’s price.

First Republic Bank

We bought First Republic around the depths of the COVID crisis. The bank has executed well over these two years, with outsized growth in loans, earning assets, deposits, and earnings. And as usual, its credit quality has been pristine. Here are the metrics over that time:

The stock continues to trade at a premium to other banks at > 20x P/E and ~2.5x TBV. Earning a good return from these levels will largely depend on continued high rates of customer growth. As long as the culture stays intact, I think the bank could grow for many years.

With that said, I find it difficult to have a strong view on future returns. I can say that upside is somewhat capped given a LDD ROE, which necessitates First Republic retaining all of their earnings if the bank keeps growing >10%.

I do expect continued excellent customer service leading to strong growth, intelligent underwriting, and increased value over time. If the company continues doing these things, the growth profile could prove very durable and an expensive looking valuation could prove to be quite reasonable.

We have owned Google since the COVID lows. I thought it was just a decent investment to make at the time - net cash balance sheet, profitable base business with strong growth, optionality in cloud, trading at maybe 18x TTM earnings (although everything was cheap at that time). My biggest worry was it was too safe and other things would return much more.

I have been quite surprised at the results since then. Core earnings have almost doubled in 2 years on strong (possibly above trend) core revenue growth and higher core margins. The cloud business has also performed and is likely to become very valuable. Capital allocation has improved with increasingly higher buybacks every quarter for a few years, leading to a majority of FCF being returned to shareholders. All of this has led to the almost shocking result that our yield on cost from fully-taxed core earnings is approaching 10% 2 years after our initial investment.

Shares also are far from expensive at current levels, trading below 20x forward core earnings + 10x run-rate cloud revenue + net cash.

Fantastic good sir.

Lots of good stuff in there, thank you for sharing your thoughts! 💚 🥃