Some Initial Thoughts on Brookfield's Oaktree Purchase

Disclosure: my clients and I are long Brookfield Asset Management (BAM)

I’m no expert by any means on Oaktree, but I wanted to go through a few thoughts I had on the deal from the perspective of a BAM shareholder. I’m going to take a look at what I think average earnings power might be, how I would expect those earnings to grow, some thoughts on valuation, and how the deal fits into BAM’s broader portfolio.

Earnings Power

Oaktree has four buckets of value - base management fee income, incentive fee income, net cash and investments on the balance sheet, and accrued carry. I think it makes sense to value each of these separately.

The net investments and accrued carry are assets held on the balance sheet. I think it makes sense to just preliminarily value those at 100 cents on the dollar. Together, they are worth $2.4 billion net of parent debt.

Now is the base management fees and the incentive fee income.

Base management fees are mostly a function of AUM. Oaktree had $120 billion of AUM at the end of 2018 and earned $790mm of base management fee revenue. There has been some recovery in the markets since the end of 2018 which would lead to higher AUM, but for simplicity’s sake I think we can use $790mm as a good revenue run-rate.

Calculating a run-rate for the incentive based fees is a bit more complex. Incentive based fees are earned on funds after they clear a performance hurdle (usually 8%). These revenues are quite lumpy from year to year, so it makes sense to look at average earnings. Here’s a table of incentive eligible AUM, incentives created net of direct costs, and those incentives expressed in basis points of the AUM:

You can see the lumpiness of this income stream. Since we’re trying to find a number for average earnings power, I’m going to use the average of 74 bps and multiply that by the $35 billion of incentive eligible AUM. That gets us to a run-rate for revenue of $259 million.

Adding the $790 million from the base management fees to the $259 million we get $1,049 million in run-rate revenue. From here, we can deduct all operational costs to find an estimate for annual earnings. Over the last four years, a time period when AUM has been pretty constant, we’ve had average operational costs of $585 million which gives us pre-tax earnings power of $464 million after deducting those costs from our revenue number. The tax-rate over the past two years has been ~10-11% so let’s say we have $415 million in after-tax, run-rate earnings.

If you’re familiar with the company, I’m looking at something similar to the adjusted net income number that Oaktree provides. Here’s the info they present:

The run-rate incentive income numbers I’ve presented are all net of the incentive income compensation numbers found under expenses. I’ve also excluded “Investment income (loss)” as we valued the assets at fair value on the balance sheet, so including investment income would be double counting. I’ve basically added the management fee revenue, the run-rate for net incentive income revenue, and deducted all of the costs out of that.

Earnings Growth

The first component of earnings growth will be the growth in AUM over time. Here’s a chart showing growth from 2000 through 2012:

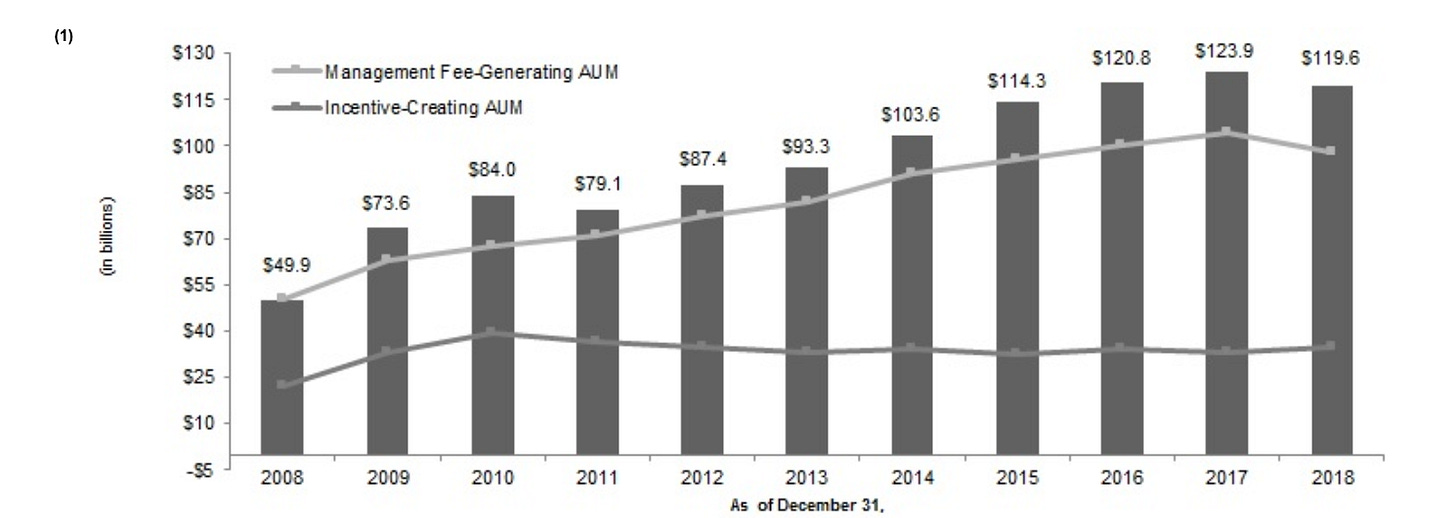

And here’s one showing growth from 2008 - 2018:

As you can see, AUM growth has been quite strong over time. I’ll talk more about this in a later section, but those of you who are familiar with Oaktree know that they’re fairly counter-cyclical investors, raising money when they see distressed investment opportunities.

What’s interesting is that over the past two cycles, they have grown AUM strongly during down markets - 56% from 2000 to 2003 and more than that through the financial crisis in 2008 - but Oaktree has kept the AUM once the economy recovered! You would kind of expect that they would grow AUM when there are good opportunities and things are cheap, then once the economy recovers AUM would go back down. But Oaktree has generally followed a trend of keeping the AUM that they gain. If they can continue that trend, then earnings should grow nicely over time.

Valuation

Brookfield bought 62% of Oaktree for $4.7 billion with a 50 / 50 cash equity split. That gave a valuation of ~$7.7 billion for the whole entity. Going back to the valuation section, there’s $2.4 billion of investment assets and $415 in run-rate earnings. That gives us a value of ~13x earnings, or an ~8% free cash yield, if we value the investment assets at fair value and back them out of the purchase price.

What kind of return can Brookfield expect on this deal? A pretty good estimate would be the free cash yield plus annualized long-term earnings growth.

Making an estimate for long-term earnings growth is tough for Oaktree. If you just compute the growth on the AUM since those charts started in 2000 you get a CAGR of 11%. As much as I’d love future growth to look like that, I don’t think it’s going to be that strong.

I also don’t buy the argument that growth will be minimal, either. There seems to be a partial consensus that the lack of growth over the last few years means that Oaktree won’t grow in the future. I disagree. Low growth in an expanding economy is the same pattern that Oaktree had during the strong economy in the mid 2000’s as well. As I noted, the growth tends to occur when times are difficult, so the last few years of no growth in a strong economy shouldn’t be much of a surprise.

It might make sense to think of Oaktree’s ability to grow AUM and earnings to be somewhat in proportion to the amount of total debt outstanding. Oaktree is more of a specialty distressed investor than a fixed income shop like Pimco that will just own anything. Pimco can pretty much grow AUM just as long as there’s client demand for their services. Since they are generalists and the fixed income market is so huge, they can probably deploy as much money as they could reasonably raise. Oaktree, on the other hand, needs relatively distressed situations to invest into. The supply of investment opportunities isn’t as high as it is for Pimco because they’re investing in a more niche, specialized way. If you gave Oaktree $300 billion tomorrow to invest, they probably couldn’t and wouldn’t do much with it.

In order to estimate growth over time, we should think of how much the fixed income market grows. A good first estimate might be that similar percentages of total debt outstanding will get into trouble over time, so as the amount of debt outstanding rises, Oaktree should be able to expand its AUM roughly in proportion with the amount of debt outstanding. We should also think that the AUM will grow counter-cyclically as it has historically. Oaktree’s AUM hasn’t tracked the growth in the fixed income market over the last few years of the economic expansion but we shouldn’t expect it to do so. Once we hit another recession and / or general time of credit market stress, we should expect Oaktree’s AUM to grow strongly into the new market opportunity.

You would also have second order effects where the past few years have seen a huge increase in debt right on the cusp of high yield, which should mean lots and lots of opportunities once the cycle turns. That could definitely be a boost to the business over the next cycle.

I think that assuming a mid single digit growth rate seems prudent. Debt outstanding is growing quicker than that, so we have a bit of allowance for Oaktree failing to capture their share of the growth, perhaps due to their general conservatism. At an initial ~8% free cash flow yield, mid single digit growth would probably mean an IRR for Brookfield somewhere in the low teens range.

Strategic Considerations

Strategically, I think Oaktree is an excellent fit for Brookfield. Both companies are known as investment managers that enter fairly complex situations and invest on a value basis. Brookfield has mentioned that they wanted to build out a fixed income arm, and Oaktree is exactly the type of manager that Brookfield would have hoped to build, so the transaction clearly fits Brookfield well and gives them management expertise and infrastructure where they previously didn’t have it.

I also think that the cash flows from Oaktree will complement those from Brookfield nicely. Although Brookfield’s business is built to withstand a tough economic environment, Oaktree’s business really shines during tough times. As we’ve discussed, they have historically grown AUM at high rates during recessions and additionally they make higher returns during these times that lead to more incentive income. You actually expect record earnings from Oaktree when times are tough. Brookfield can withstand tough times and make investments that should pay off well over time, but in a recession the actual cash flows will be a bit weaker than you would expect otherwise. Marrying these two together should provide for a more recession resistant cash flow stream, giving Brookfield the ability to have even more firepower just when the company would like to have it.

Additionally, Brookfield has talked about how low interest rates have boosted their business - institutional investors like the consistent returns available from hard assets and those returns are even more attractive when the worldwide risk-free rate is incredibly low. Brookfield would have a slight headwind if interest rates increased materially from today’s levels. On the other hand, Oaktree faces a completely opposite situation - they’re fixed income managers! When bond yields are low compared to risk assets it makes business tough, so if we get a world with somewhat higher rates, Oaktree’s business should do well and can be something of a cushion to Brookfield’s.

The last piece has to do with synergies. On the cost side, Oaktree will continue to manage its own business. I’d expect some cost to come out since they need less reporting as they are no longer public. One data point is that Liberty Latin America’s overhead increased by ~$25 million once they became public, so perhaps Oaktree could save a similar amount. That could provide ~$300 million in value to Brookfield shareholders.

On the revenue side, I must say that I have no idea if there will be synergies. I would imagine that most of the big institutional investors are well aware of both Brookfield and Oaktree, and if they’re using one company’s product but not the other’s today, then I don’t see why this acquisition would lead someone to change their mind on that. Obviously Brookfield’s people can talk up Oaktree to their clients (and vice versa) but I don’t believe institutional investors should or would be swayed by that thinking. Perhaps I’m being naive.

Conclusion

This deal looks like a good strategic fit for Brookfield to me, both culturally and on how the cash flows and businesses will complement each other. Financially speaking, I think the price was reasonable and I would expect something like a low-teens IRR for Brookfield. I think that estimate is fairly conservative and there’s definitely a possibility for higher returns. That will be dependent on whether Oaktree can continue its strong historical growth.

While low teens returns are good, you do need to think of those returns in relation to Brookfield’s opportunity cost. If they were to simply repurchase its own stock I believe they would make a similar, low-teens return. For that reason, I like the deal mostly on the aforementioned strategic considerations.

Disclosure: Pursuant to the provisions of Rule 206(4)-1 of the Investment Advisors Act of 1940, we advise all readers to recognize that they should not assume that recommendations made in the future will be profitable or will equal the performance of past recommendations. This publication is not a solicitation to buy or offer to sell any of the securities listed or reviewed herein. This contents of this publication are not recommendations to buy or sell any of the securities listed or reviewed herein. Investing involves risk, including risk of loss. The contents of this publication have been compiled from original and published sources believed to be reliable, but are not guaranteed as to accuracy or completeness. Kyler Hasson is an investment advisor and portfolio manager at Delta Investment Management, a registered investment advisor. The views expressed in this publication are those of Kyler Hasson and not of Delta Investment Management. Kyler Hasson and/or clients of Delta Investment Management and individuals associated with Delta Investment Management may have positions in and may from time to time make purchases or sales of securities mentioned herein.

[jetpack_subscription_form show_only_email_and_button="true" custom_background_button_color="undefined" custom_text_button_color="undefined" submit_button_text="Subscribe" submit_button_classes="undefined" show_subscribers_total="false" ]