Liberty LILAK: Recovering Nicely After Hurricanes

I have owned Liberty LILAK for a little while. Those that follow it know that it hasn’t exactly done well over the past couple of years. There has been trouble at one of its big segments and a couple of hurricanes that severely impacted earnings power starting in late 2017. At this point, it seems that perhaps we have turned a corner - hurricane effects have lessened and subscriber losses in its troubled segment seem to have bottomed.

Because of the hurricane, minority interest positions, and some M&A, it’s a bit of a chore to actually calculate how much LILAK is earning. I’m going to give an overview of the company’s operating segments then map out some estimates for run-rate earnings power. After that I’ll go over some strengths and weaknesses of the company and its competitive position and some thoughts about potential returns.

Overview

LILAK has a lot of moving parts, so I think it’s important to give an overview of its operating assets. We’ll start with what they owned at YE 2017 so we can see how the company changed over the course of 2018 due to M&A.

2017 Segments and Ownership:

C&W - operates in 18 countries, primarily in Lat Am and the Caribbean. ~80% owned.

VTR - operates in Chile. 100% owned.

Puerto Rico - 60% owned.

2018 Segments and Ownership:

C&W - same operations. ~81% owned.

VTR - operates in Chile. 100% owned.

Puerto Rico - 100% owned.

Cabletica - operates in Costa Rica. 80% owned.

As you can see, in 2018 LILAK bought in a bit of the minority interest at C&W, bought the 40% of the Puerto Rican assets that it didn’t own (funded with LILAK stock), and bought Cabletica, which owns cable systems in Costa Rica.

These assets are pretty similar to most other cable systems that investors would be familiar with. They operate high-speed broadband and video assets with triple play offerings across the footprint and are trying to offer fixed - mobile convergence as well. One area that separates LILAK from some other cable companies is that it has a relatively large mobile business at its C&W segment.

Estimating OCF

A few notes on the OCF numbers I’m going to use:

LILAK reports OCF as its EBITDA equivalent number, so I’ll be using that term here.

Hurricanes Maria and Irma in late 2017 adversely affected some of LILAK’s operations, mostly in Puerto Rico. I’m interested in LILAK’s earnings power, not necessarily its actual earnings, so I’m going to use estimates for unaffected earnings through 2017 and 2018.

For 2018, I’m going to try to use an annualized OCF number for Cabletica, even though it has only been owned since October 1.

I’ll quote total OCF at segments first then map it back to proportionate numbers

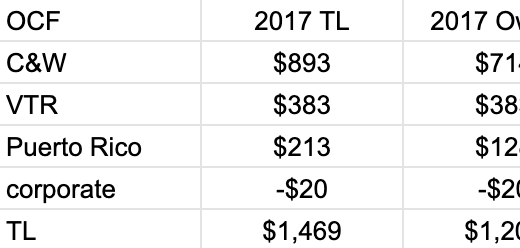

Here are the total and owned OCF numbers from 2017:

These numbers are adjusted for the hurricane, with $17mm of hurricane costs added back at C&W and $80mm of hurricane costs added back at the Puerto Rico segment.

Here are the total and owned OCF numbers from 2018:

These numbers are adjusted in the following manner:

C&W - $13mm deducted from OCF for an insurance payment that was included in reported OCF results.

VTR - deducted $10mm of OCF from newly acquired Cabletica which is now reported in the VTR segment.

Puerto Rico - used numbers adjusted for estimated hurricane costs for Q1 - Q3. Also adjusted down for $60mm of insurance payments and an FCC payment in Q4.

Cabletica - annualized the $10mm of OCF reported in Q4 (purchased on 10/1 so includes a full quarter). LILAK quoted the multiple on the purchase at 6x including synergies, which would give an annual number for OCF of $50mm, so there could be a bit of upside here.

2018 Results

2018 results actually looked pretty good to me. I care the most about organic OCF growth.

C&W

C&W has been the main problem child for LILAK over the past couple of years. They paid way too much for it and OCF has come in very weak. However, 2018’s results looked fairly encouraging. OCF grew maybe 1% organically once you add back hurricane impacts from 2017 and deduct the insurance payment from 2018.

While that isn’t exactly great, I think there are a couple of mitigating factors. They’ve been dealing with subscriber losses in the wireless segment. They had 100% market share in the Bahamas and now have some competition, which has inevitably taken some share. In all, they lost lots of mobile subscribers in 2018. On the other hand, Q4 performance was much better than the rest of the year, so they saw good improvement towards the end of the year. Management also mentioned on the call that they actually added mobile subscribers in December and January. Mobile is the part of LILAK that I feel the worst about as it faces the most competition, so if that stabilizes then I’d feel good about the C&W business as a whole. The rest of C&W is made up of those high speed cable assets that investors like so much.

VTR

VTR, for me, shows the potential that LILAK holds. VTR is primarily cable and was undisturbed by the hurricanes. Currency neutral OCF grew by 6% last year on strong revenue growth.

Puerto Rico

Puerto Rico has been a success story from a recovery standpoint. If you would have told investors that Puerto Rico would be pretty much fully recovered only a little over a year after the hurricanes, they would have been ecstatic. Puerto Rico was doing $200-210mm of OCF before the hurricanes, and while I quoted $187mm in OCF this year, that’s with heavy adjustments for estimated hurricane costs. Q4 OCF looked a bit lower than I thought it would be after adjusting for the FCC and insurance payments, although I’m not particularly surprised that the results were quite noisy. Perhaps the best data point for going forward earnings power is that Puerto Rico did $15mm in OCF in December. If you annualize that you’d get $180mm in OCF, and management indicated they see some growth in the next couple of years as the country continues to recover.

Cabletica

There isn’t much to report here as it has only been owned by LILAK for one quarter. Management indicated it was tracking in front of expectations, which would be $50mm in OCF, but we’ll need to wait a bit to see how it progresses.

Corporate

It’s never good to see corporate costs more than double, but the increase from 2017 to 2018 was the result of extra costs in order to run a public company (LILAK was hard spun out of LBTYK at the end of 2017).

Valuation, Cash Generation, and Return Profile

Using the numbers from above, LILAK had TTM proportionate OCF of $1,316mm in 2018. It also has $5,380mm of proportionate net debt and 181mm shares outstanding. Using today’s price of $18.98, it’s trading at 6.7x EV / proportionate OCF.

In order to calculate free cash flow, I’ll simply take OCF - capex - interest expense. The 2018 capex numbers were lumpy due to the hurricane, but we can use the capex guidance of 19% of revenues for 2019 as a guidepost. On owned 2018 revenue, that would mean $643mm of capex. Using the company’s borrowing costs of 6.5% on average, we’d also get ~$370mm of net interest expense. So for our fcf estimate we have right around $300mm, or about $1.65 / share. (note: the company guided for $125mm of fcf in 2019, which looks low to me. I emailed IR about the discrepancy and am waiting to hear back)

I value anything with a decent amount of leverage using a sort of truncated DCF model. For any one year period, the gain in intrinsic value for the equity will be the gain in enterprise value divided by the ratio of equity to enterprise value, if you’re assuming a constant EV / EBITDA multiple. I use that to forecast a longer-term IRR. The model effectively assumes a constant leverage multiple on the EBITDA and a constant EV / EBITDA multiple.

I’ll assume 2% organic EBITDA growth for now. Here’s what the numbers look like:

EV growth = organic EBITDA growth + fcf / EV = .02 + ( 300 / (5380 + 181 * 19)) = 5.4%

Leverage multiple = EV / equity value = 2.56x

TL intrinsic value growth to the equity = 5.4% * 2.56 = 13.9%

Note: if you just map out 1 year returns assuming 2% OCF growth of 2% and $300mm of cash generation, put the same 6.7x OCF multiple on it, and deduct the debt to find the value of the equity, you’ll see that it’s 13.9% higher than this year’s value, exactly what the model says. I won’t bother to prove the math out.

I like to think in terms of 10 year IRRs. So what that model says is that if LILAK organically grows EBITDA at 2% CAGR for the next 10 years, if it keeps its leverage ratio at ~4x (imagine it uses fcf and incremental debt proceeds to buy back stock), and if it trades at a constant EV / EBITDA multiple of 6.7x, then the IRR to the equity holders will be ~14%.

You can easily switch some of the assumptions around. Here’s a chart showing the IRR to the equity given some different organic EBITDA growth scenarios:

The second sensitivity would be related to actual fcf generation. If LILAK’s actual earnings power was $200mm annually instead of the $300mm that I estimated, then those IRRs would all be ~3% lower (i.e. 2% IRR for -2% growth, 7% IRR for 0% growth, etc.).

Last, there’s sensitivity on the valuation. A 1x turn difference higher or lower on the terminal EV / EBITDA multiple would lead to a ~40% difference in return. That’s a big sensitivity because the equity is such a small portion of the total EV. 40% is a big number and obviously that can (and most likely will) have a large effect on actual equity returns going forward.

Conclusion

LILAK certainly looks interesting here around $19. The company is trading at an EV / EBITDA multiple less than 7x, and if you map the actual free cash flow generation abilities you see that the levered fcf yield to the equity is a bit under 9%.

The original premise of the company since the spinoff has been that cable has lots of room to run in LILAK’s markets because of underpenetration relative to developed markets. This gap should close over time along with growing incomes. Higher revenues would generate higher margins and lower capex intensity, which paired with a levered equity model would lead to probably 20%+ equity returns.

So far we haven’t really seen that come to fruition as there have been problems at C&W and disruptions from the hurricanes. With these levered equity models, small changes in performance lead to very big changes in intrinsic value growth, as we’ve seen.

I tend to think that organic OCF growth will be positive over time, although probably not at the rate that some envision. While it is true that demand for communications services should be growing at high rates in LILAK’s end markets, the microeconomics aren’t nearly as attractive as they are for cable companies in, say, the US, which enjoy very large speed and cost advantages over competitors. Importantly, US cable companies also don’t have that many competitors. Competition in LILAK’s markets has been much tougher than in the US, and I generally believe that that will continue to be the case. I don’t think that leads to terrible results, but all you need is for results to continually be not quite as good as hoped for - a little less OCF growth than you expect and/or a little higher capex. If that general view is correct, then perhaps you’re looking at OCF growth in that 2% range and IRRs somewhere around 15% or a bit higher. Then if the multiple expands you could make quite a bit more (and if it contracts you’d make quite a bit less!).

The last piece is what your opportunity cost ought to be for this type of investment. There’s a lot of leverage, foreign market risk, foreign currency risk, and lots of competition. Double digit returns are great but the risk profile here is undoubtedly high. For me personally, my most directly comparable investment would be Charter (disclosure: long both personally and for clients) where I see IRRs getting close to 20%. So LILAK, which to reiterate, clearly has more risk than Charter, needs to make me more than that on an expected basis or else I’d rather just own more Charter. For now, I continue to hold a small position in LILAK but it isn’t convincing enough of an opportunity for me to hold a bigger stake.

Disclosure: Pursuant to the provisions of Rule 206(4)-1 of the Investment Advisors Act of 1940, we advise all readers to recognize that they should not assume that recommendations made in the future will be profitable or will equal the performance of past recommendations. This publication is not a solicitation to buy or offer to sell any of the securities listed or reviewed herein. This contents of this publication are not recommendations to buy or sell any of the securities listed or reviewed herein. Investing involves risk, including risk of loss. The contents of this publication have been compiled from original and published sources believed to be reliable, but are not guaranteed as to accuracy or completeness. Kyler Hasson is an investment advisor and portfolio manager at Delta Investment Management, a registered investment advisor. The views expressed in this publication are those of Kyler Hasson and not of Delta Investment Management. Kyler Hasson and/or clients of Delta Investment Management and individuals associated with Delta Investment Management may have positions in and may from time to time make purchases or sales of securities mentioned herein.

[jetpack_subscription_form show_only_email_and_button="true" custom_background_button_color="undefined" custom_text_button_color="undefined" submit_button_text="Subscribe" submit_button_classes="undefined" show_subscribers_total="false" ]