Markel: A Follow Up on Ventures and Intrinsic Value Growth

After my last post on Markel (disclosure: long a tiny bit) I wanted to go back and look at two things. First, how has the company done with its ventures segment? Second, how has intrinsic value compounded over the past few years.

Ventures

I had mentioned that I was a bit worried about capital allocation at Markel because there had been some write downs in the ventures and other units (ventures holds privately owned non asset management / insurance businesses while other holds a few asset management reinsurance companies). After the first write-up, it wasn't entirely clear to me just how well the company has done on its private investments, so I decided to take a closer look.

The following chart shows the dollar amount spent on acquisitions in the ventures segment as well as an estimate for earnings for ventures as a whole. Just like in the last post, I'm estimating earnings as EBITDA - capex with a full tax rate. This does not account for the reinsurance management businesses held in the "other" segment (including Markel CatCo, which just had a writedown).

I've adjusted the writedowns out of the EBITDA numbers, since I'm just looking for cash on cash IRR numbers. Ventures did $166mm of EBITDA - capex in 2018, which also happens to be a clean run-rate number. I mentioned that I think that cash flow stream is conservatively worth ~$1.4bb. Instead of giving you the IRR for that value, I'll just give you the range. If you value ventures at $1.2bb, $1.5bb, or $1.8bb, the IRR on the total spend would be 10%, 14%, or 17%, respectively. I have excluded a small bakery acquisition in the early 2000's, but that wouldn't affect the IRR much.

10-17% is pretty good! Especially if you're worried about ventures. Worst case, you're still making double digit IRRs, which is better than what they're making on their equity portfolio. Additionally, like I mentioned last time, I'm allocating all the debt to the insurance segment, so all of these IRRs are unlevered. It's not like they're making 10% IRRs with 5x EBITDA leverage or anything like that.

I will reiterate that this just accounts for the venture segment and does not include CatCo, State National, or Nephila. CatCo is where they had the $200mm writedown and $175mm of losses in its investment products. State National and Nephila are both fairly recent so it's difficult to get a sense for exactly how those are doing. I think of these businesses as separate from ventures, but if you want to add the CatCo disaster into the calculations, it lowers the IRR by ~3%, which is obviously significant.

Intrinsic Value Growth Since 2014

The second thing I was curious about is the actual rate of intrinsic value growth over the past few years. We know that the results over a couple of decades have been excellent, but Markel is not the same company that it was in the late 1990's. For this exercise, I'm going to look at the growth in intrinsic value from the end of 2014 through the end of 2018. I'm choosing the end of 2014 because that includes a full year of Alterra's results, which was a transformative acquisition.

One important note before I do this exercise. Last time, I didn't elaborate much on what a fully levered balance sheet looks like for Markel. Whenever you're valuing an insurance company, you need to make some decisions on how much equity-like investments a company's balance sheet will support.

Insurers' assets are funded by debt, equity, and insurance liabilities (or float, as Buffett calls it). Different companies are comfortable with different levels of equity like investments. Some, like Travelers, invest all of their float in fixed income securities and only invest a small portion of their own shareholder's equity into stocks. Others, like Berkshire, are comfortable investing roughly all of their own shareholder's equity into stocks. If you look at a Berkshire balance sheet, you'll see that the company almost always holds cash + fixed income >= float liabilities. The assertion that Berkshire "uses float to invest in stocks" has not historically been true, at least over all of the periods where you can see its numbers. Berkshire has earned an equity like return on its shareholder's equity and supplemented that with bond income and underwriting profits, which is what has produced such outstanding gains. This math was outlined in my previous Markel article.

Back to Markel: since 2004 the company has averaged investing ~80% of its own tangible book value held in the insurance segment in equities. Here's a chart showing Markel's investments in equities as a percentage of its insurance operations' tangible book value:

The average is ~80%, but the company has no problem investing roughly all of its own equity into stocks.

Figuring out a number to use in the model is important, because if you think about the value drivers, you're basically saying that some portion of the tangible book value of the company is earning an equity-like return (call it 8%) and the remainder will be invested in fixed income earning a fixed income type return (call it 3%). The difference in intrinsic value gains over time between investing half of your TBV in stocks and all of it in stocks is quite large.

I'm going to just say that 100% of Markel's TBV will be invested at equity-like returns. Using a lower number would be more conservative, but the company has showed that if it sees opportunities it likes then it doesn't mind holding lots of stocks. As a matter of fact, Markel's balance sheet is currently the most levered it has ever been in the last 15 years as a result of the $975mm Nephila acquisition. I'd expect them to let cash and bonds build up on the balance sheet for a little while to get a bit more liquidity.

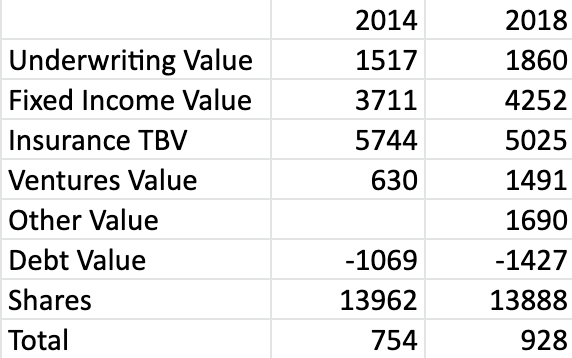

Now, onto the numbers. I performed the same valuation for the end of 2014 that I did in the last article. I used the same estimates for interest rates and taxes that I did in 2018 to take the effect of macro changes out of the picture. The only adjustment is to value 100% of TBV at 100 cents on the dollar because I'm assuming Markel will use all its TBV to earn an equity like return. I've adjusted the company's fixed income balances to reflect that fact. Here are the numbers:

Those results aren't exactly great. Growth in intrinsic value has been 23%, or a 5.3% CAGR. The results should be ~10% if the original model was correct, so it isn't great to see actual results fall well below those numbers. One mitigating factor is that the S&P 500 is only up 32% over that time period, so the lag in performance isn't humongous. 23% growth in intrinsic value would be worse if the S&P was up, say, 50%.

What Happened?

I went back and tried to map out income, growth, and capital allocation to try to tease out the reason for the underperformance. Even though these are just rough numbers, it's clear that performance hasn't been great over the last four years.

My method was to find the expected gains in intrinsic value from the big buckets that I have been discussing - underwriting income, bond income, equity income, and ventures income and growth.

For example, my model says that Markel should earn ~3% annually on its fixed income portfolio, it should underwrite at a 95% combined ratio, it should earn an equity-like return on its TBV in the insurance segment, and ventures should grow a little bit each year. Since the value of the whole company has only grown at 5.3% per year, obviously something hasn't worked out like it should have.

I went back to each year, looked at all of the business results, and aggregated them to get a more clear picture. Based on beginning levels of premium volume, bond investments, equity investments, and ventures net income, here is the total value that each of those buckets should have produced:

Underwriting Income, estimated at 95% combined ratio, 65% tax rate from 2015-2017 and 21% tax rate in 2018 - expected net income of $552mm. Actual net income of $355mm.

Bond returns, estimated at 3% after tax - expected net income of $1,710mm. Actual net income of $823mm.

Equity returns, estimated with 100% of TBV invested in equities at 8% annual returns - expected gain in value of $1,949mm. Actual gain in value of $1,430mm

Ventures - estimated 3% annual growth in net income, capital deployed at 9% fcf yield (in line with my estimated fair value multiple). $477mm in capital was actually deployed off of a starting value of $765mm ($84mm EBITDA - capex at 9x multiple). The expected value was $1,316mm and the ending value was $1,494mm.

Basically, underwriting results have come in a bit weaker than expected, interest income has been much lower due to low interest rates, and the returns from the equity portfolio haven't been as high as hoped, although the company has done well with its ventures arm.

With these results in hand, we can actually drill a little deeper. On the equity side, the S&P returned 7.6% on average during this period, compared to our estimate of 8%. That accounted for $75mm of results lower than expected. Second, if you recall, Markel didn't invest all of its TBV into equities over that period, which hurt intrinsic value gains by a further $446mm. Last, while Markel outperformed the market on average, it relatively underperformed when it had more money, which hurt returns by another $60mm.

On the private investing side, the company lost ~$380mm on its Catco purchase, although it created an extra ~$180mm in value over and above what we expected in Markel ventures.

On aggregate, the company gained ~$2.35bb in value over the 4 year period. Based on the initial model, and with a bit of compounding, I would have expected something closer to $4.5bb of intrinsic value gains. The mix of weaker than expected underwriting results, low interest rates, conservatism on the balance sheet, lower than hoped for equity returns, and the large loss at Markel CatCo led to the vast majority of this underperformance (Two quick notes. 1. These are rough numbers and there are a lot of moving parts. There are further considerations like currency movements, mark to market movements on the fixed income portfolio, buyouts of minority interest, etc. etc. 2. This assigns no value at all to an acquisition at the end of 2018 in ventures. I don't know the purchase price, but if they bought it for $200mm then I'm undercounting the intrinsic value gain by that same number. We'll find out the exact number when the 10-K comes out.). What makes me feel somewhat okay with this is that the majority of this underperformance came from low interest rates and an underlevered balance sheet. The only big mistake was Markel Catco.

Conclusion

To be frank, Markel hasn't performed as well as I had hoped. The growth in intrinsic value over the last four years has not been great. The company has been somewhat penalized for its conservatism, both in its fixed income portfolio and its allocation to equities. Furthermore, the company can't control interest rates or industry loss ratios. While they did make a large mistake at CatCo, their other investments in Markel Ventures have generally worked out well. They outperformed the stock market by a bit on average but were somewhat unlucky that they underperformed when they had relatively more money.

Moving forward, I think an investor can safely assume higher interest rates, competent underwriting albeit probably with low growth, and intelligent although perhaps unspectacular capital allocation. That should probably blend out to better results than we've seen in the last few years but not close to what the company was doing for the couple decades before that. Just how the gains in intrinsic value unfold will probably depend on how tough the insurance business is over the next decade and where exactly interest rates settle.

I like the company, and I like the management, but I'm not sure if Markel is a no-brainer type of investment here. The intrinsic value should grow over time, and Markel should outperform in difficult periods, but I'm not certain that the intrinsic value will be growing at a high enough rate for me to be interested. You can earn a very solid return owning Berkshire Hathaway (disclosure: long) with a bit less exposure to insurance and probably higher quality businesses on aggregate.

Disclosure: Pursuant to the provisions of Rule 206(4)-1 of the Investment Advisors Act of 1940, we advise all readers to recognize that they should not assume that recommendations made in the future will be profitable or will equal the performance of past recommendations. This publication is not a solicitation to buy or offer to sell any of the securities listed or reviewed herein. This contents of this publication are not recommendations to buy or sell any of the securities listed or reviewed herein. Investing involves risk, including risk of loss. The contents of this publication have been compiled from original and published sources believed to be reliable, but are not guaranteed as to accuracy or completeness. Kyler Hasson is an investment advisor and portfolio manager at Delta Investment Management, a registered investment advisor. The views expressed in this publication are those of Kyler Hasson and not of Delta Investment Management. Kyler Hasson and/or clients of Delta Investment Management and individuals associated with Delta Investment Management may have positions in and may from time to time make purchases or sales of securities mentioned herein.

[jetpack_subscription_form show_only_email_and_button="true" custom_background_button_color="undefined" custom_text_button_color="undefined" submit_button_text="Subscribe" submit_button_classes="undefined" show_subscribers_total="false" ]